Condo Insurance in and around Strongsville

Welcome, condo unitowners of Strongsville

Condo insurance that helps you check all the boxes

- Columbia Station

- Brunswick

- Medina

- Berea

- North Royalton

- Cuyahoga County

- Medina County

- Lorain County

- Olmsted Falls

- Olmsted Township

- North Olmsted

- Cleveland

- Parma

- Brook Park

- Hinckley

- North Ridgeville

- Independence

- Parma Heights

- Fairview Park

- Rocky River

- Westlake

- Lakewood

- Bay Village

- Grafton

Welcome Home, Condo Owners

When it's time to wind down, the safe place that comes to mind for you and your favorite peopleis your condo.

Welcome, condo unitowners of Strongsville

Condo insurance that helps you check all the boxes

Protect Your Condo With Insurance From State Farm

That’s why you need State Farm Condo Unitowners Insurance. Agent Jerod Scheetz can roll out the welcome mat to help provide you with coverage for your particular situation. You’ll feel right at home with Agent Jerod Scheetz, with a hassle-free experience to get reliable coverage for your condo unitowners insurance needs. Customizable care and service like this is what sets State Farm apart from the rest. Agent Jerod Scheetz can help you file your claim whenever life goes wrong. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

Don’t let fears about your condo make you unsettled! Reach out to State Farm Agent Jerod Scheetz today and find out how you can benefit from State Farm Condominium Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Jerod at (440) 243-9167 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

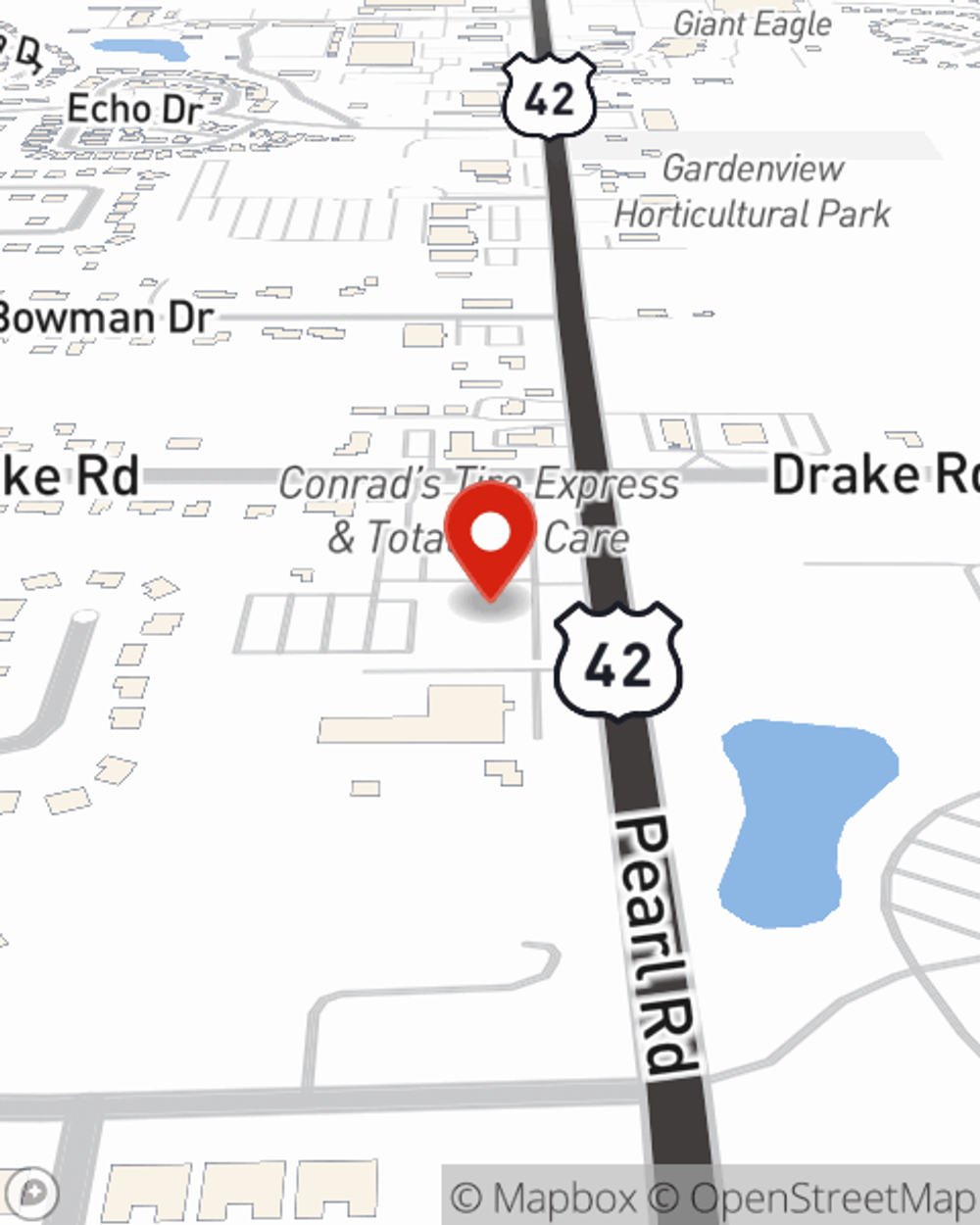

Jerod Scheetz

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.